For what it’s worth…

This post does not contain the answer to the conundrum of how to express value, but hopefully it will help to broaden minds and spark conversations. In order to reimagine the global economy with distributed ledgers, we also need to reimagine the paradigm of how we express how much things are worth.

Working full time in the crypto industry (and the payments industry, but people ignore that more boring part when I tell them what I do for a living) has one particularly annoying side effect; the neverending commentary on the “price” of crypto from people around me:

- “Oof… Crypto’s way down this week, Joe”

- “Have you seen how much crypto has gone up this morning?

- “I read that crypto’s in a bad way. Are you OK?”

- “Bitcoin is at $60k at the moment, right? Wow, maybe I should have listened to you the last time I asked you”

Sometimes, I try to get them to understand the concept of “zooming out” (to think more long-term). Other times, I attempt to engage them in a conversation on what things are worth; what the value of any currency is, what the stock price of Tesla is today and why, where the market value of crude oil is and where it’s going as compared to the MPG one gets from the fuel one buys, etc. Their eyes tend to glaze over and seldom is any ground won.

Thankfully, I now have a blog in which to get this out of my system.

So, here’s a very short list – in no particular order – of things to consider that just might help to spark some thoughts regarding how allocating value to resources, goods and services is nowhere near as simple as assigning a fiat currency amount to them.

- The comparison problem

- Money Supply

- Circumstantial Value

- Primary vs. Secondary Value

- Subjective Value

- How blockchain technology can help

The Comparison Problem

Probably the first topic to consider when deciding what something is worth is the unit that is being used to measure said worth.

When someone asks me how tall I am (which they often do as I’m taller than average), I sometimes reply “This tall!” (holding one hand level with the top of my head). Other times I reply “1 Joe tall”. It’s a silly thing to say, but it also contains a serious point.

How much is 1 Bitcoin worth? Compared to what? The only way to answer 100% accurately is that 1 bitcoin = 1 bitcoin.

So, 1 USD = 1 USD, 1 kg of gold = 1 kg of gold, 1 EURO = 1 EURO, 1 Joe is 1 Joe tall… and so on.

As discussed in previous posts, though, the whole point of trade and currency is that people want to exchange things with one another that are not identical. Generally speaking, it is believed that value can be expressed accurately and universally by using a fiat currency value. But look!:

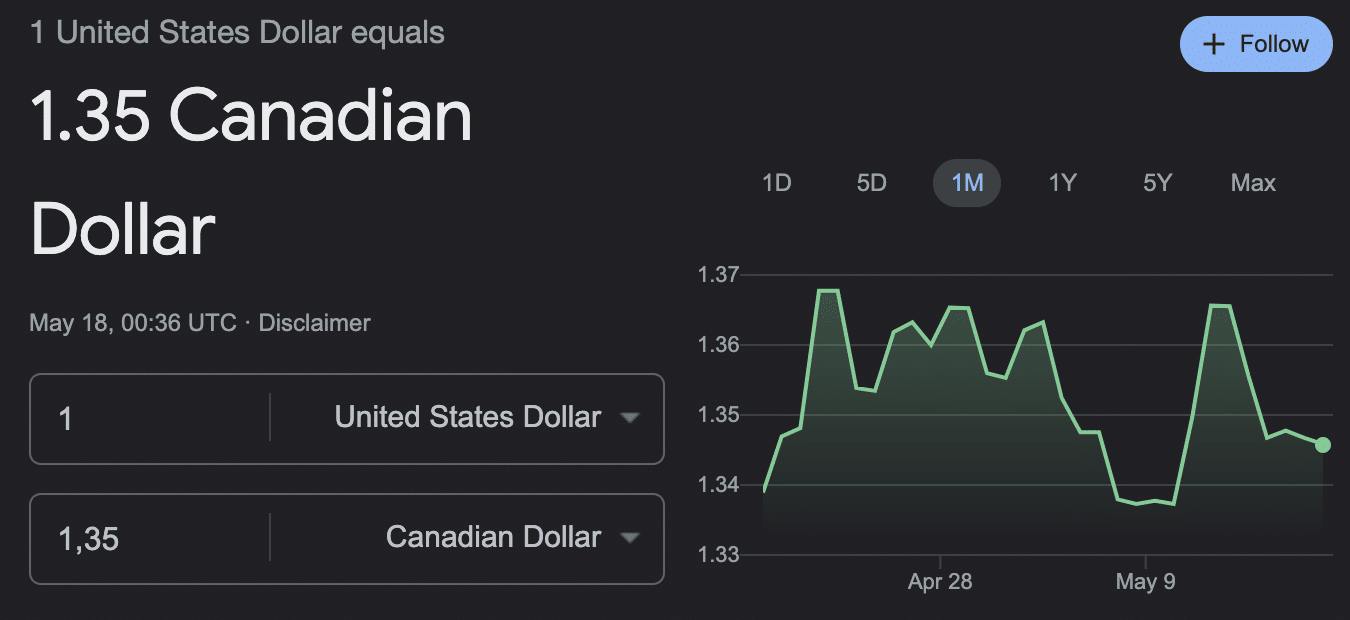

In this chart, you can clearly see that the Canadian dollar vs. the United States dollar is not always “worth the same”, and vice versa.

But wait, if we’re speaking about fiat currency, there are a whole series of other problems; money supply, inflation… and the simple fact that it’s not backed by anything tangible whatsoever!

What money supply does to how much things are “worth”

What money supply does to how much things are “worth”

Imagine a small island. Nobody leaves and nobody enters. The island has a total of 1 million IID (Imaginary Island Dollars) in circulation. This is enough for the islanders to use in their daily lives and the local economy works just fine.

Now, imagine the Governing Body of the IICB (Imaginary Island Central Bank) has a genius idea to increase the prosperity of the island; they create an additional 1 million $IID and distribute it to the population proportionally according to how much they already have.

Suddenly, as if by magic, everyone has twice as much money as before! Hoorah!

What would you expect to happen to prices? If before the doubling of the money supply a loaf of bread cost 1 $IID, will it stay at 1 $IID? Will all the islanders all be able to buy houses that are worth double and drive much fancier cars?

How about if they travel abroad and convert their $IID to $USD? Will they suddenly be able to get double the amount of other currencies also at the airport’s Bureau de Change?

Without going into details, I think all of our intuition tells us that this would not be the case. Otherwise, all central banks would be doing this all the time (even more than they already do!). Prices and foreign currency exchange rates would be adjusted to compensate for the new currency in circulation and 1 $IID would have approximately HALF THE SPENDING POWER of 1 $IID before the experiment began.

This is, in very simple terms, what is happening to the fiat currencies we use in real life. The SPENDING POWER of the currency is diluted by the new money that is injected into the system.

So, according to this logic, the value of a currency could more usefully be defined by what one can buy with it, rather than the other way round.

So… How many grams of bread is 1 $IID worth? Or even, How many loaves of bread is this lambo worth?

Circumstantial Value

Would you rather have a Lamborghini or a loaf of bread?

How about if your family is starving to death?

Another one of the issues we run into when trying to define value is the fact that what is more valuable in one moment is not necessarily more valuable in another. The above example is amongst the most obvious ones; the most “expensive” things in the world – in terms of fiat equivalent value – would often be entirely worthless in extreme situations such as natural disasters, war or economic collapse.

We’ve all seen apocalyptic movies, the type where people find themselves thrust into desperate situations. Food, water, a spade or a stout stick could make the difference between life and death. Would you pick a diamond ring or an axe during a zombie apocalypse?

Primary Vs. Secondary Value

I studied Psychology at A-Level (pre-university) and I’ll always remember something my teacher taught us about fiat money.

He demonstrated it by taking some paper money out of his pocket and tearing it up. It made everyone (poor students wanting beer money) very nervous indeed; there were actual gasps of shock!. He then went on to point out that such a strong reaction to the destruction of a piece of paper is pretty weird. I have replicated this experiment with people many times over the years.

You can’t eat money, you can’t build a shelter out of money, you can’t drink money… Of course, you can acquire primary resources with money so long as it is still generally believed to be worth something, but it simply is not a primary resource! Despite this, the way the human brain works – the ease with which we create symbolic relationships – makes money into potentially the only thing that we consider a primary resource, when it’s actually not one.

This has profound implications for the way our economy works, the way many people value money – often above all else. People will accumulate more and more money, even after all their primary needs have been more than covered, in the same way squirrels hoard acorns.

Subjective Value

The last measure of value I’ll mention for today is the subjective, individual value that we each assign to things.

From great works of art to little trinkets we’ve collected over our lifetimes, collectibles or photographs, each and every one of us have things that are priceless to us, but would be worthless to anyone else.

Similarly, each of us would pay a premium for certain things that others would see no value in whatsoever.

This is common knowledge, to be honest, Something my mum often said when pricing products in the family business:

- How much do you think this is worth, Mum?

- Whatever someone will pay for it, Joe!

If you really think about it, the idea of fiat money being worth anything at all is subjective. It only works because it’s a belief that is shared by the majority of the population.

How can blockchain help to give some clarity?

Before wrapping up, I’d just like to reiterate that the above points are not intended to give answers. Rather, I am raising topics that a lot of people rarely think about. In order to imagine a better future, one must first be aware of the reality of what one already has.

There are several ways that blockchain can help to provide some clarity on the above matters:

- An end to inflation, or more controlled inflation

- Tokenisation of real-world primary assets

- Gold, water, energy, carbon in the form of rainforests… The possibilities are endless. This is a topic I am particularly passionate about.

- True globalisation of the economy

- Globalisation is a dirty word in certain circles, but I believe that global borderless trade could lead to great prosperity for mankind.

- Fewer intermediaries

- Less need for people, companies and governments to keep track of transactions on ledgers means there’s less work to be done, fewer fees and greater efficiency of the system.

Of course, I will be returning to many of these themes, but it’s good to get some of these concepts out there for further discussion.

Please do leave some comments below. I love hearing your thoughts and feedback.